Tax Compliance Flow for Foreign Independent Service Providers

Complete guide to understanding and fulfilling your tax obligations in Sri Lanka as a foreign independent service provider

Benefits of Paying Tax

Taxes fund infrastructure projects, education, healthcare, and public services that benefit society. By paying your taxes, you contribute to national development and enjoy the benefits of a functioning society.

Legal Framework

From April 1, 2025, freelancers and independent service providers in Sri Lanka are subject to updated income tax rules, particularly concerning foreign currency income. Whether you offer digital services, work remotely, or run a side business, understanding how the Inland Revenue Department (IRD) classifies your income is crucial for staying compliant.

Income Tax Rates for YA 2025–26

- Tax-free allowance: LKR 1,800,000

- Next LKR 1,000,000: 6%

- Balance income: 15%

Penalties for Non-Compliance

Late Filing Penalty (Section 178)

The greater of:

- 5% of the tax owed, plus 1% for each month (or part thereof) of continued non-compliance.

- Rs. 50,000, plus an additional Rs. 10,000 for each month after November 30, 2025.

Example: If your tax liability is Rs. 200,000 and you file your return 6 months late:

- 5% of Rs. 200,000 = Rs. 10,000

- 1% for 6 months = 6% of Rs. 200,000 = Rs. 12,000

- Total penalty: Rs. 22,000 or Rs. 50,000 (whichever is greater).

False or Misleading Statements (Section 181)

Penalty is the greater of:

- Rs. 50,000

- The amount by which the tax payable would have been reduced or the refund increased.

Example: If you incorrectly claim a tax refund of Rs. 100,000, the penalty could be up to Rs. 100,000.

Failure to File (Section 189)

Subject to:

- A fine up to Rs. 10 million

- Imprisonment up to 2 years

- Or both such fine and imprisonment.

Example: If you completely fail to file your return and the IRD detects it, you may face severe penalties, especially for significant tax evasion.

Tax Compliance Flow Guide

Follow this step-by-step guide to determine your tax obligations and compliance requirements.

Are you older than 18 years?

You are under 18 and not required to pay tax at this time.

Are you an Independent Service Provider (freelancer) or an Employee?

You are required to submit quarterly tax returns on time via RAMIS.

Keep track of your income and expenses for accurate tax computation.

If you don't have a TIN or PIN, we will guide you through the process next.

Common Questions for Independent Service Providers

Your employer deducts tax at source via PAYE.

You should ensure your TIN and tax details are up to date.

If you don't have a TIN or PIN, we will guide you through the process next.

You need to pay tax in each month when your total accumulated earnings exceed 1.8 million.

Tax rates: 6% for first 1 million, then 15% for the balance.

If you don't have a TIN or PIN, we will guide you through the process next.

Common Deductions & Allowances

- Personal Relief: Every individual taxpayer is eligible for a personal relief amounting to LKR 1,800,000 per year. This reduces your taxable income.

- Non-allowable Expenses: Reimbursed expenses by your employer or company and personal non-business expenses.

Let's start with your TIN details.

1. Do you have a TIN?

1.1 Do you have a PIN?

1.1.1 Is your TIN connected with your Email?

Do you know how to connect your TIN with Email?

→ Just visit IRD and it will be done same day.

→ You can request online via IRD portal.

→ Just need to sign a letter and send to IRD.

Do you log in to the RAMIS system?

→ Please contact IRD to activate your RAMIS login.

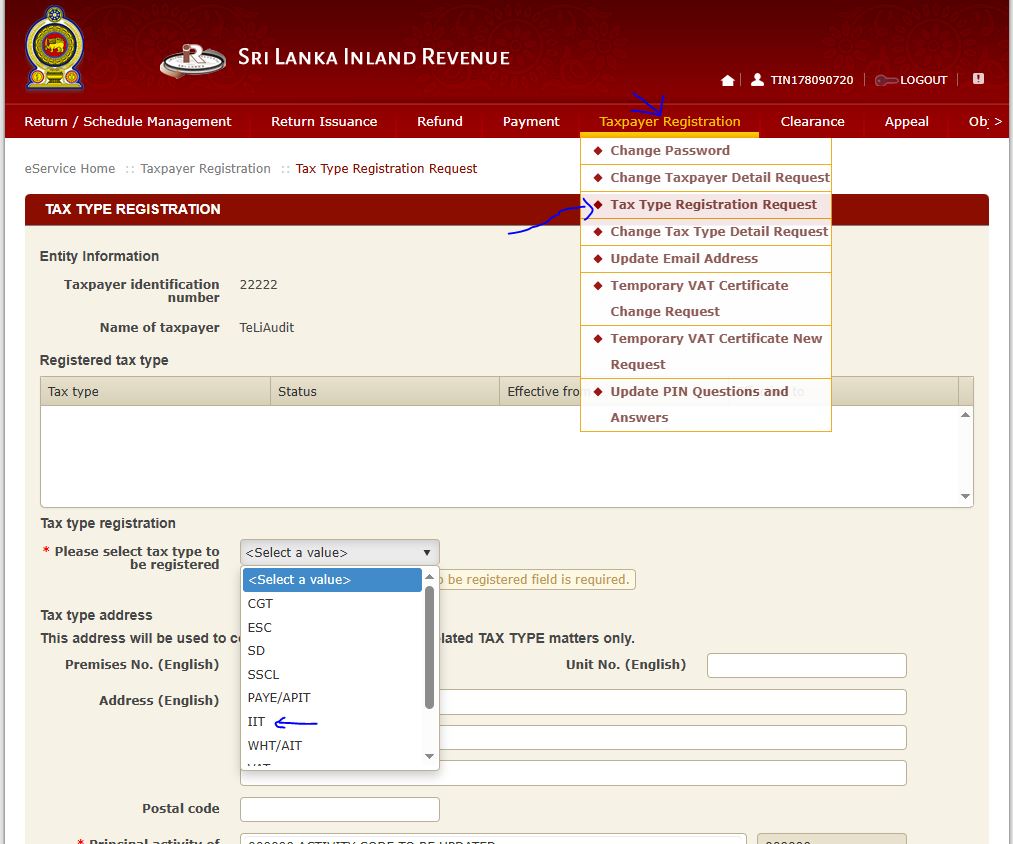

Is your tax type registered?

→ Register your tax type via IRD online portal.

Are you an independent taxpayer?

→ You must submit your quarterly return via RAMIS.

→ Your process is complete.

→ Please obtain your PIN from IRD:

→ Visit the nearest IRD office with your ID. They will provide your PIN immediately.

How would you like to connect your email with IRD?

→ Send a signed letter and your ID copy to IRD's official email. Processing may take more than a week.

→ Visit the nearest IRD office to connect your email with them and reset your password.

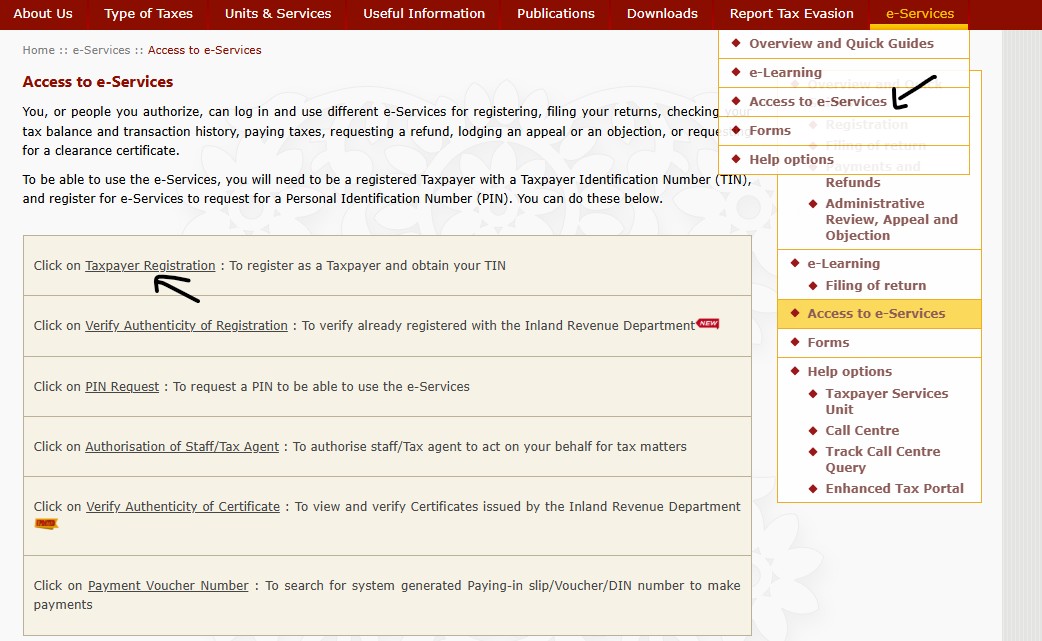

1.2 Do you want to register for a TIN?

How would you like to proceed with TIN registration?

→ You can register your TIN online through the IRD portal.

If IRD says you have already registered, how do you get your TIN?

→ Call IRD helpline and request your TIN information. Call to 1944 dial 1132

→ Visit the nearest IRD office with your ID and request your TIN.

→ OK, thanks.