How pay from Bank

How do I pay my tax payment through the bank?

tharaka Asked on Dec 11, 2025 10:33

bank ird

How do I pay my tax payment through the bank?

tharaka Asked on Dec 11, 2025 10:33admin Dec 11, 2025 10:35

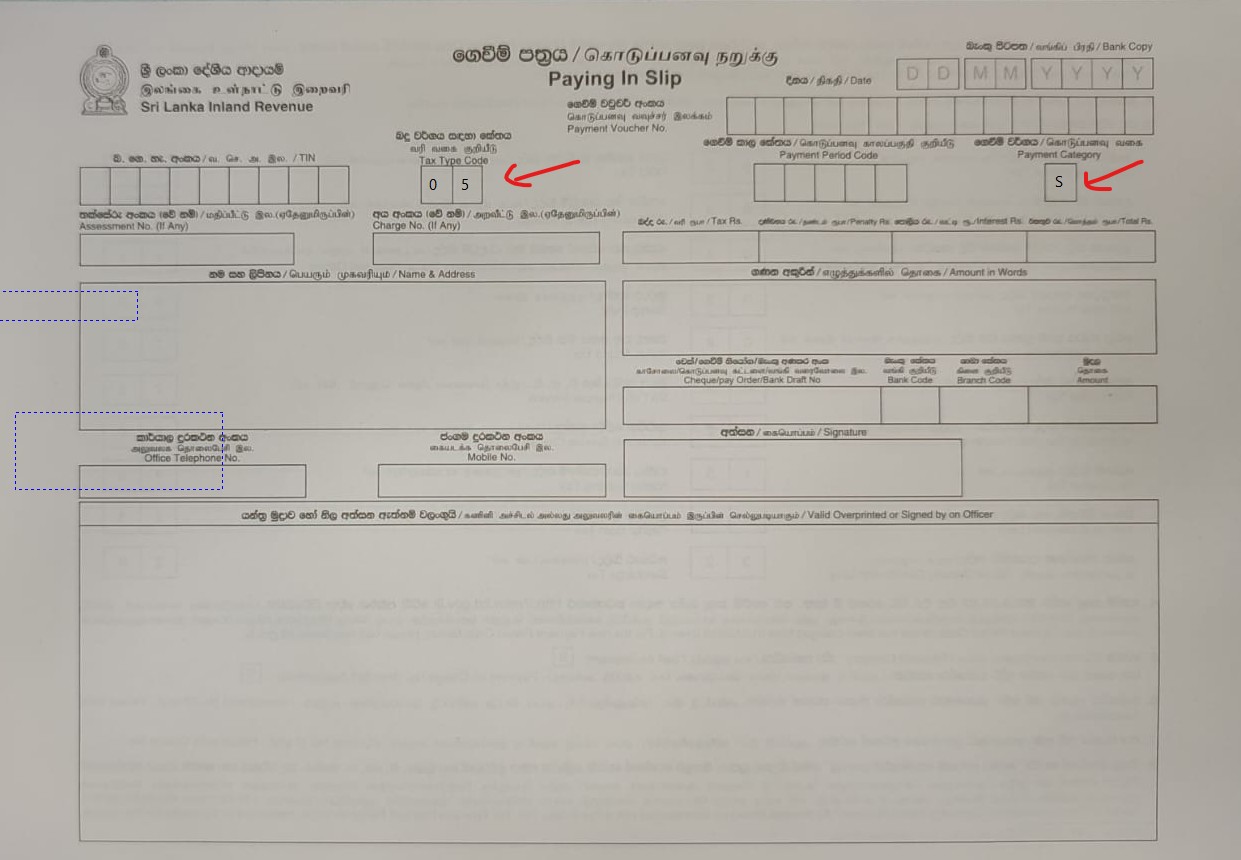

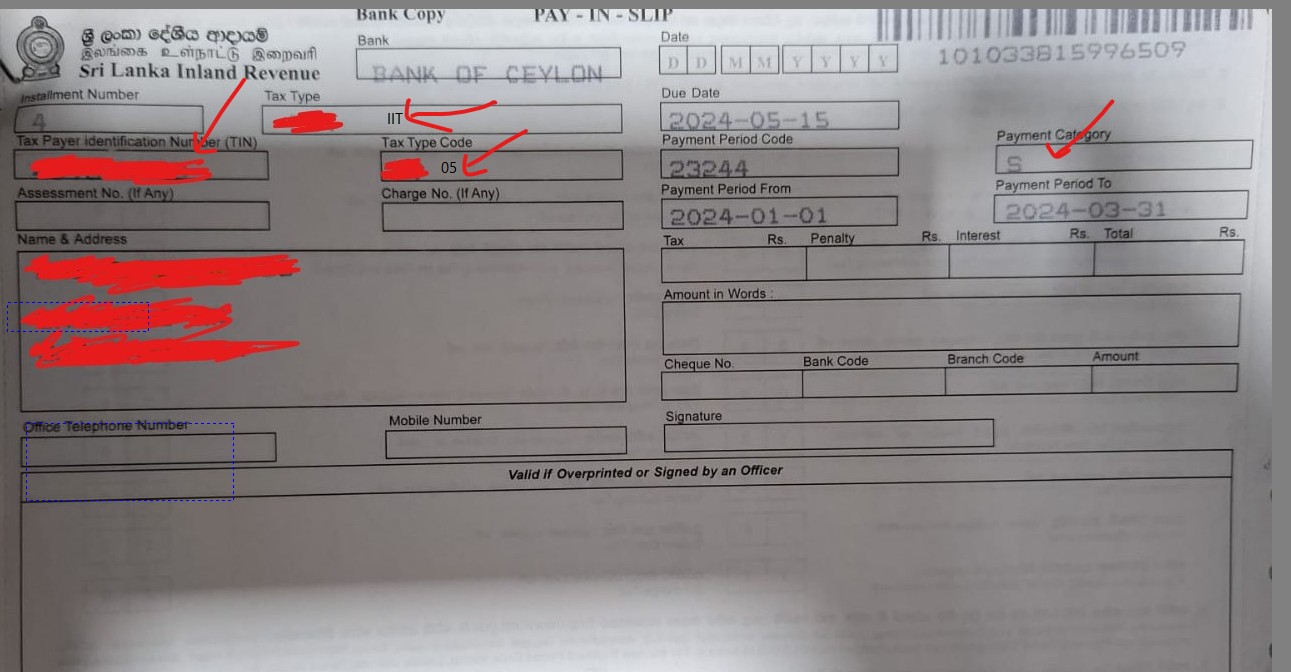

Can you please identify your payment slip and fill it as mentioned?

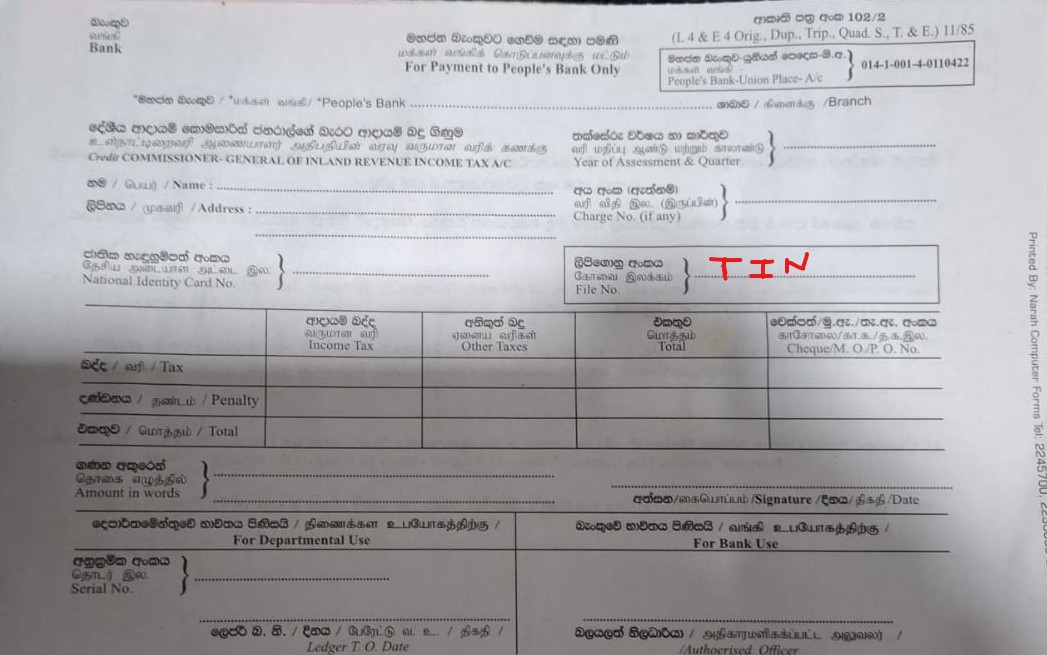

slip 01

Link to this reply

Link to this reply How to change my Name on IRD ( RAMIS )

Asanka Asked on Dec 02, 2025 02:18admin Dec 02, 2025 02:59

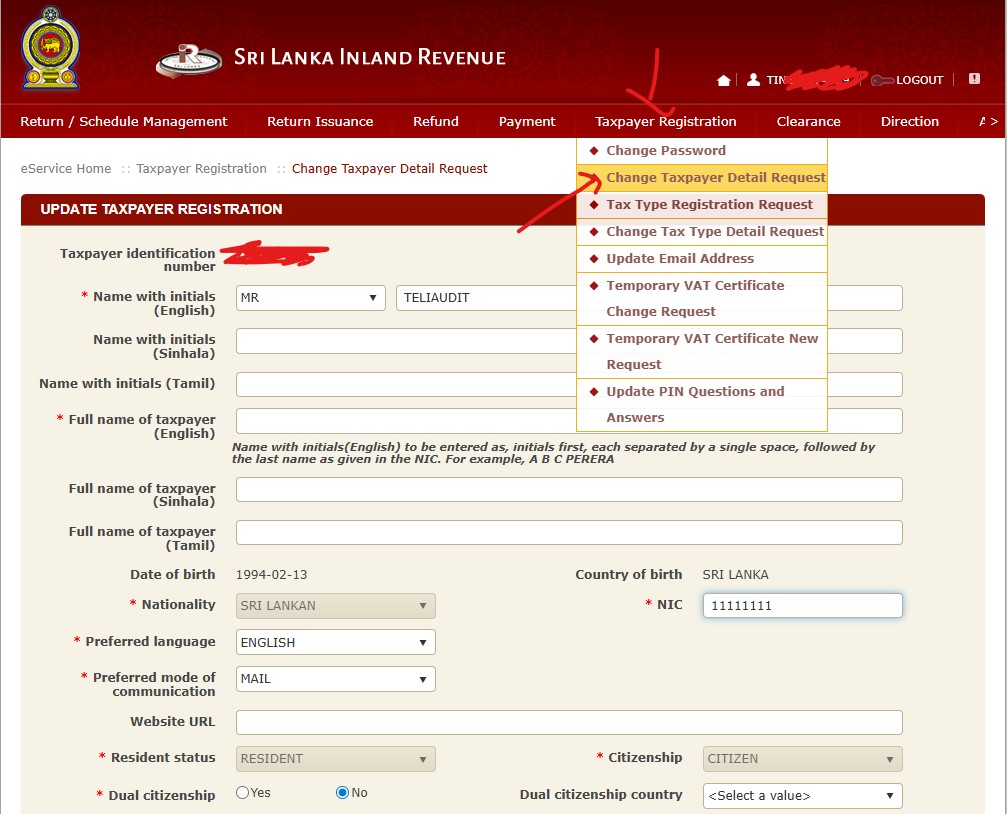

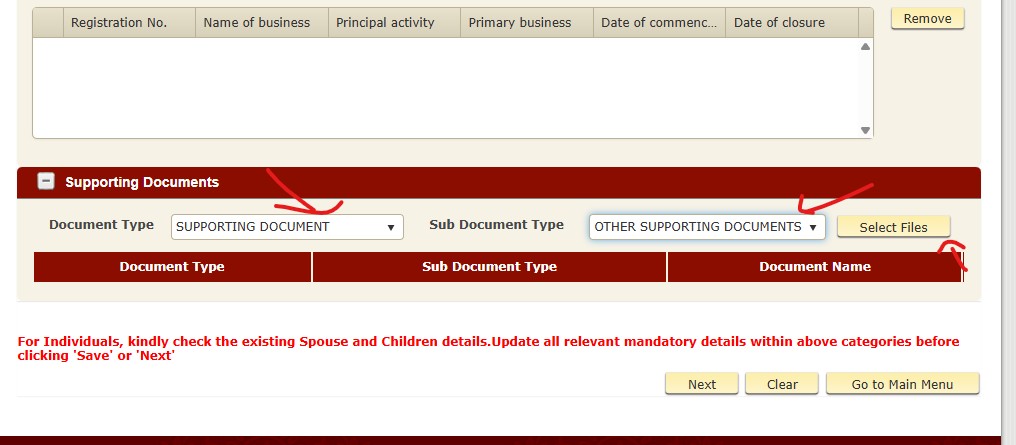

follow the step below to change your name in IRD - RAMIS

My tax type is in inactive mode, How do i activate it

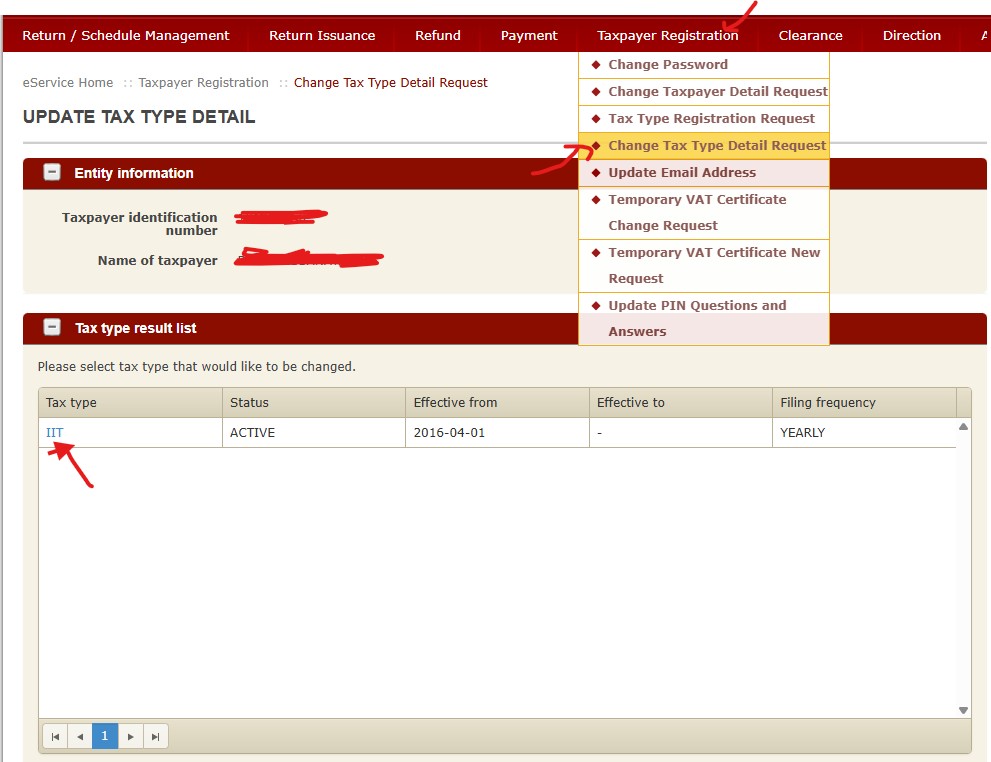

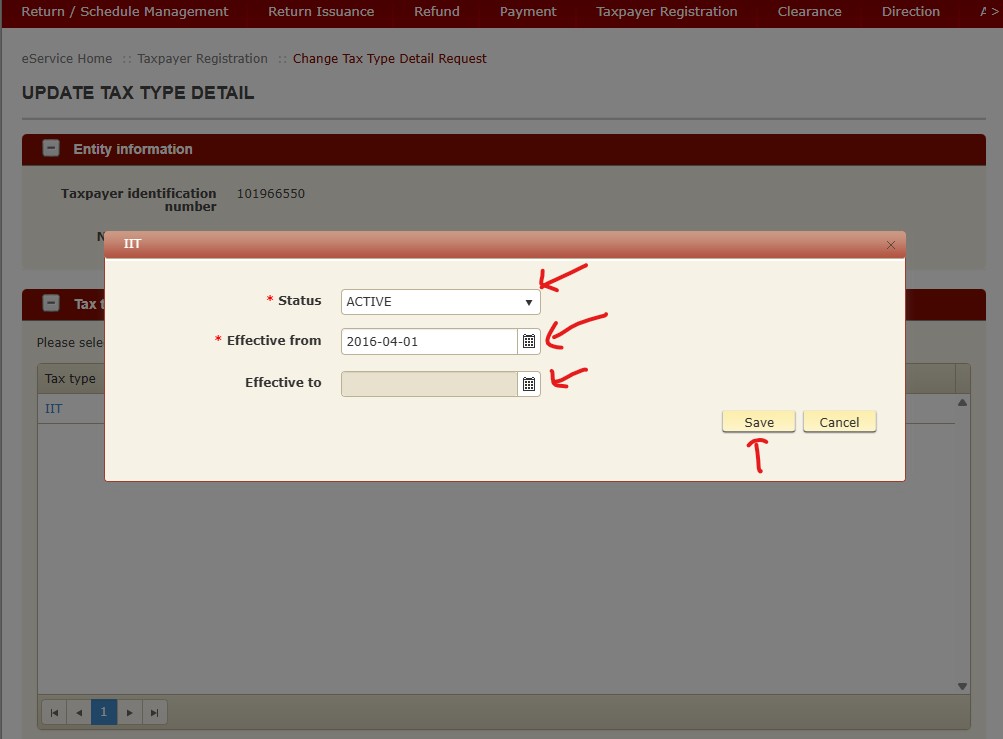

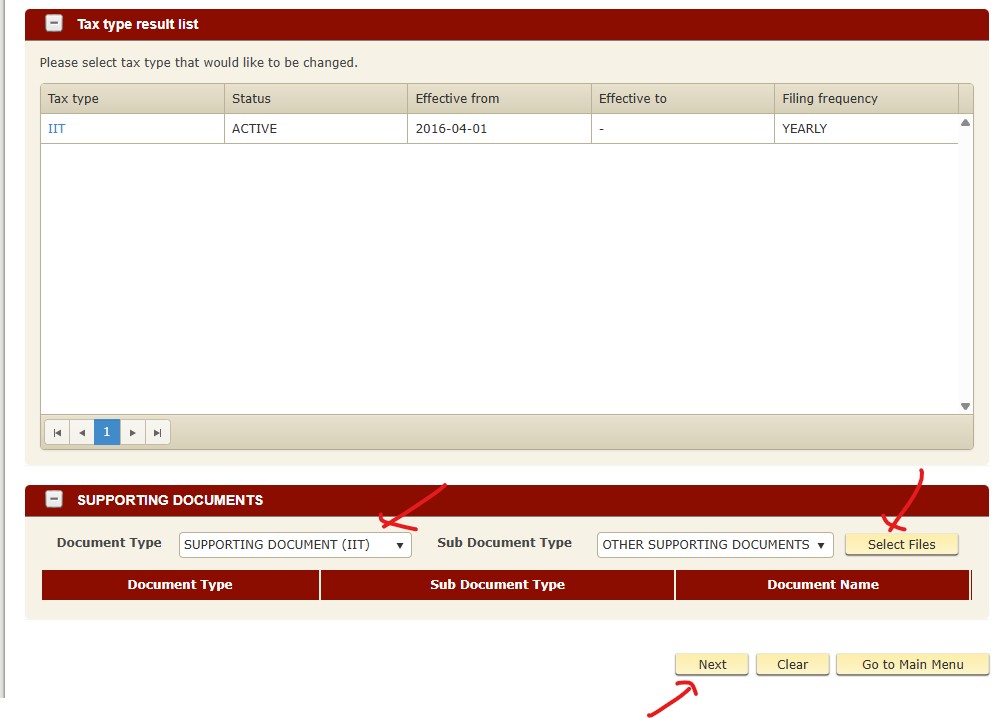

Abdul Asked on Nov 22, 2025 03:08admin Dec 02, 2025 03:02

Follow the step below to activate your Tax Type

How to Create DIN number or Payment vouchar number

Rasidu Asked on Nov 07, 2025 03:43How to check Taxable Years in IRD

sadaru Asked on Oct 24, 2025 04:24