How to pay IRD via Combank

Please let me know how to pay via Combank digital

Lalith Asked on Aug 22, 2025 12:25

combank ird pay

Please let me know how to pay via Combank digital

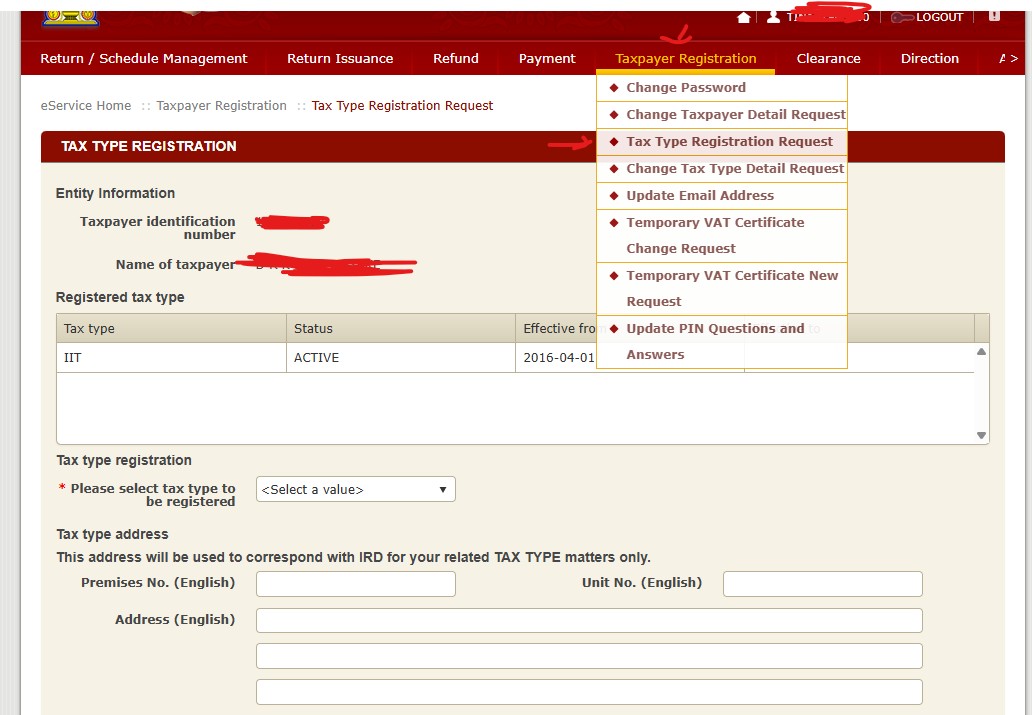

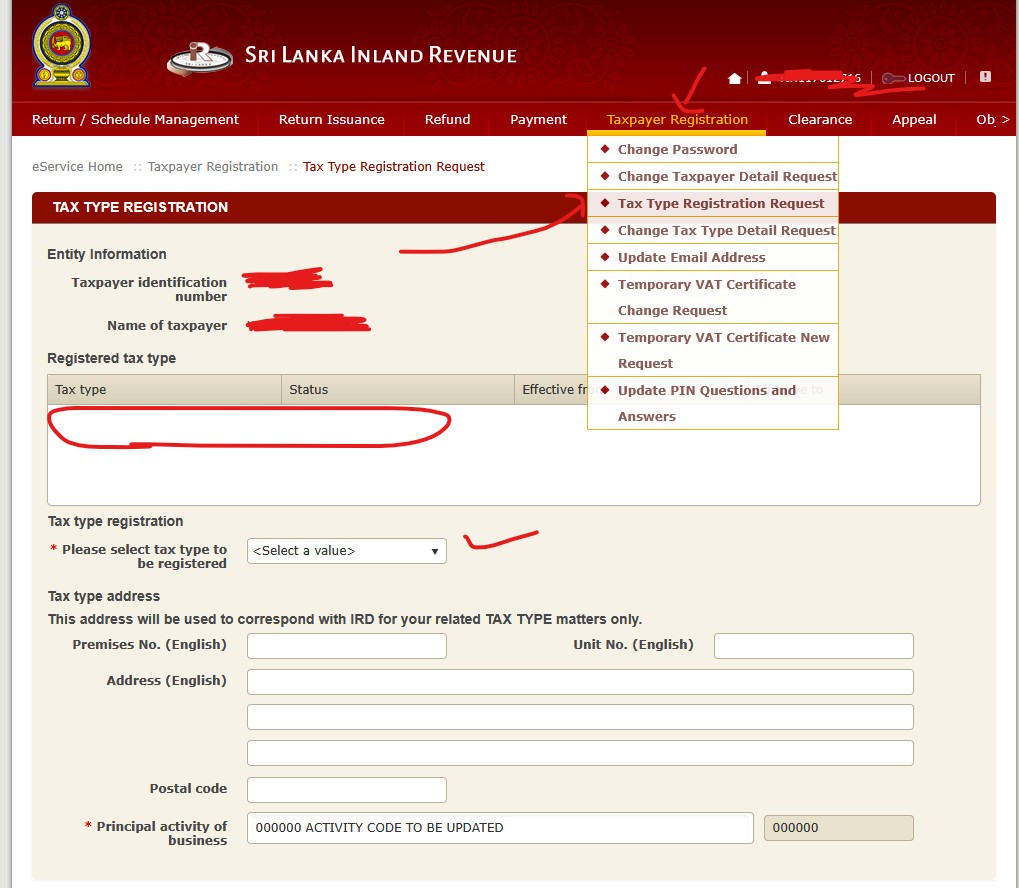

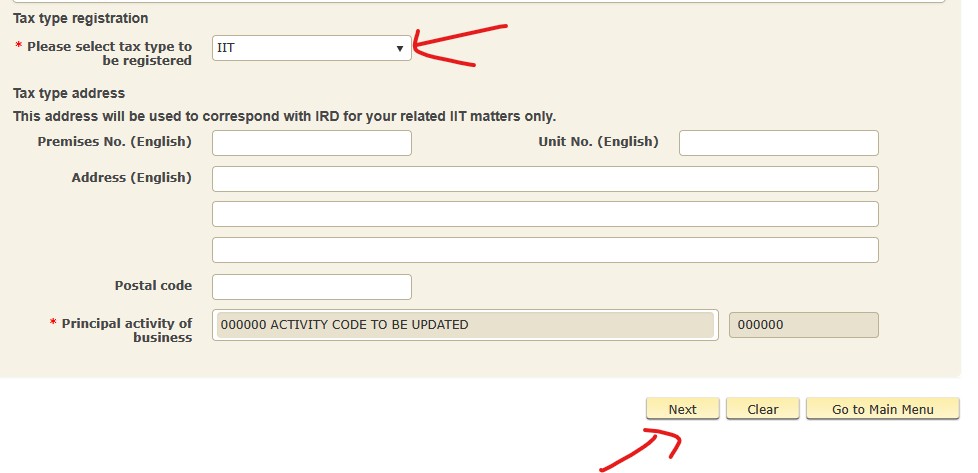

Lalith Asked on Aug 22, 2025 12:25Can some one guid me to check tax type

suresh Asked on Aug 22, 2025 12:16admin Dec 02, 2025 03:59

Please follow the step below

Can I add expenses reimbursed by the company?

shan Asked on Aug 09, 2025 10:15When will it open for company tax computation for year 24/25

Saranga Asked on Aug 03, 2025 11:37